Is Iraq’s ecosystem investment ready?

Originally published in the fifth issue of Five One Review.

ECOSYSTEM OVERVIEW

The Iraqi startup ecosystem started with a bang this year. In Q1 of 2022, we witnessed an unprecedented $10.5M investment round (Baly) and $5M (TipTop). The excitement revolved not only around investment value but also around the investor profile. Specifically, Baly’s round was a testament to regional and international investor appetite in Iraq. The investors were diverse - from China (MSA Novo), UAE (March Holding), and Sweden (Vostok Ventures). Another interesting attribute is that both startups were early stage.

Unfortunately, the initial thrill of Q1 seemed to fizzle out by mid-year. The expected ripple effect of those two initial deals did not materialize. During Q2 of 2022, there was no publicly reported investment activity. The remainder of 2022’s rounds were six-figure or less. With only one public round in 2022 (Nakhla), Euphrates Ventures seemed to have disappeared from the scene. Although the dollar amounts of 2022 surpassed last year, 2021 displayed consistency in value, investor profile, and disbursement of funds across all four quarters. So, what happened to the investment buzz? Were Baly and TipTop just one-off anomalies?

BENCHMARKING AGAINST INVESTMENTS IN MENA

For a more holistic view, let us dig deeper and see how Iraq’s investment trends stack up against MENA’s. According to Wamda and Digital Digest’s October 2022 report, the value of deals in the region witnessed a 331% year-on-year increase compared to October 2021. As of today and based on our conservative estimates, Iraq is on a similar positive trajectory. Iraq’s year-on-year investment value increased by around three-quarters (72%) - mainly attributed to Baly’s and TipTop's groundbreaking rounds. While seed and pre-seed activity witnessed a drop in the MENA region, the value and number of seed-stage rounds in Iraq remained relatively stable.

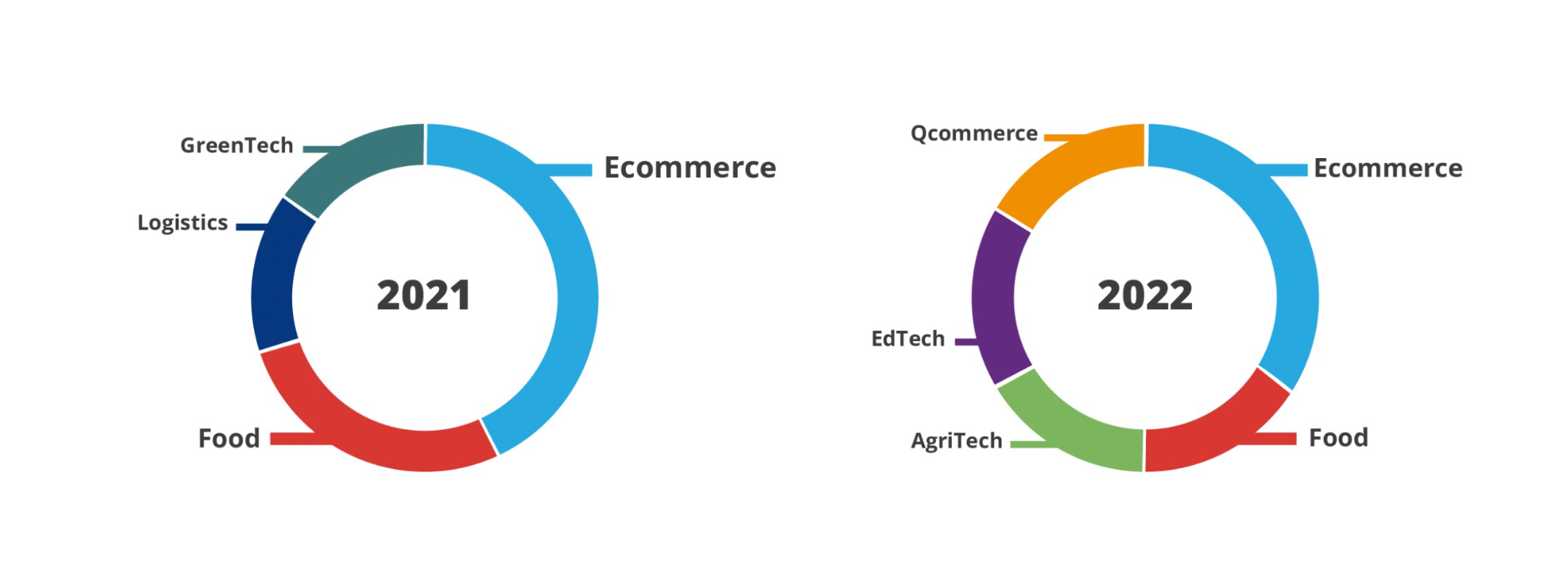

MENA investors poured money into two main industries - cleantech and fintech. Fintech startups received the most attention, with startups such as MoneyFellows ($31M), Telda ($20M), and MaxAB ($40M). Meanwhile, cleantech startup, Yellow Door Energy, led the biggest raise with a mega-round of $400M. Iraq’s investment landscape observed very divergent sectoral inclinations. Ecommerce continues to reign as king. Historically, cleantech in Iraq received its share of attention. New contenders have sprouted, notably agritech (Nakhla) and edtech (IoT Kids). This sectoral interest is consistent with social and economic needs. Fintech, on the other hand, is still nascent. Mohammed Koperly from Al Nesoor Law firm attributes this to “complex ambiguous laws and regulations applying to banks, financial institutions, and insurance companies if they carry out such regulated activities.” And that is why we notice a proliferation of wallet and prepaid solutions. Interestingly enough, ecommerce platforms are exploring new and innovative methods of circumventing the lack of fintech solutions, particularly startups such as Orderii, Simma, and ToolMart.

LOOKING FORWARD: SOLUTIONS AND NEXT STEPS

Last month, Five One Invest buckled down and organized a roundtable session to uncover the gaps facing investors…what were the missing pieces of the puzzle? The online roundtable invited fifteen international, regional, and local investors to discuss investment barriers and potential solutions.

The discussion uncovered four main steps to be taken to facilitate involvement in the Iraqi ecosystem:.

Addressing startups' investment readiness gaps such as basic accounting.

Contextualizing Iraq’s ecosystem by providing a holistic overview of the investment and entrepreneurial landscape.

Presenting Iraq’s startups at regional events (such as Step, Rise Up, Gitex, etc.).

Building trust among regional and local investors through investor networking, relationship building, and knowledge sharing.

Supporting the survival of later-stage startups by increasing the ticket size and de-risking through co-investment and the participation of larger investors.

Quite a few ecosystem players have taken measures to champion the ecosystem further. Earlier this year, Iraq Venture Partners (IVP) and Five One Invest launched a joint pilot investment readiness program. The joint pilot program provides startups tailored support through Five One Invest that addresses gaps before the IVP investment transpires. The type of support includes financial modeling, pitch deck readiness, due diligence, and customer experience evaluation. Other entities in the market run similar programs, such as The Station, Kapita, and Cross-Boundary. However, there is still space for development.

Within Iraq, there is no shortage of educational and informative content. Local players such as Iraqi Innovators, Kapita, and Five One Invest produce articles, reports, and content with in-depth analysis of the ecosystem landscape. Engaging the international and regional content houses, however, is what warrants attention. A few regional players, such as Wamda and Magnitt, report on Iraq’s entrepreneurial scene, but it is still insufficient to attract regional attention.

These past two years have presented Iraq’s startups with regional and international exposure. In 2021, Rabee Securities, a well-established Iraq-based securities brokerage firm, hosted five Iraqi startups (Miswag, AlSaree3, KESK, IQ Cars, and Zaytoon) to represent at the Iraq Pavilion EXPO 2020. Earlier this year IQ Cars, an automotive marketplace app, flew out to Websummit, an annual technology conference in Portugal. Also, four startups, JobStudio, Orderii, STEMile, and Eduba ايدوبـــا, showcased and networked with regional investors during the MENA ICT Forum, a two-day forum focused on tech in the MENA. It is refreshing to see opportunities opening up, albeit slowly and far between.

The two other main challenges, developing relationships between regional and local investors and supporting later-stage startups through co-investment, remains tricky. But that is what we are here for…watch this space!